Singapore CA Qualification Professional Programmes

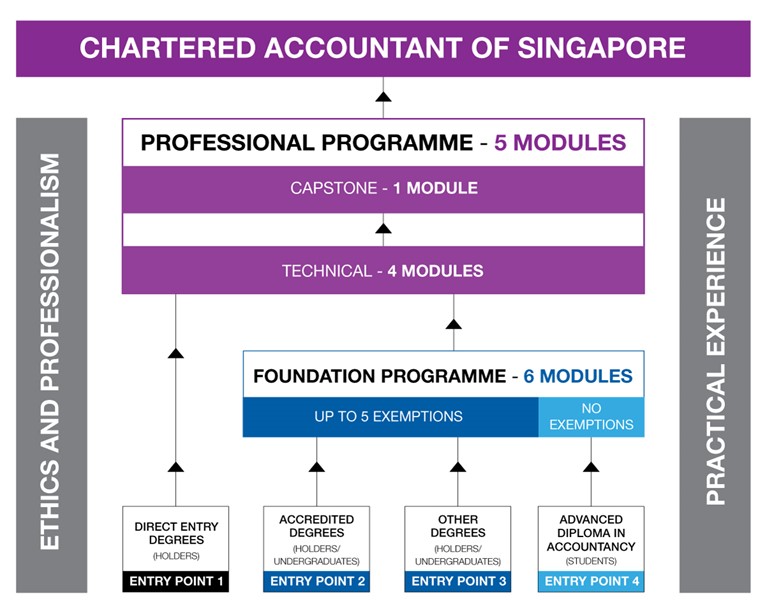

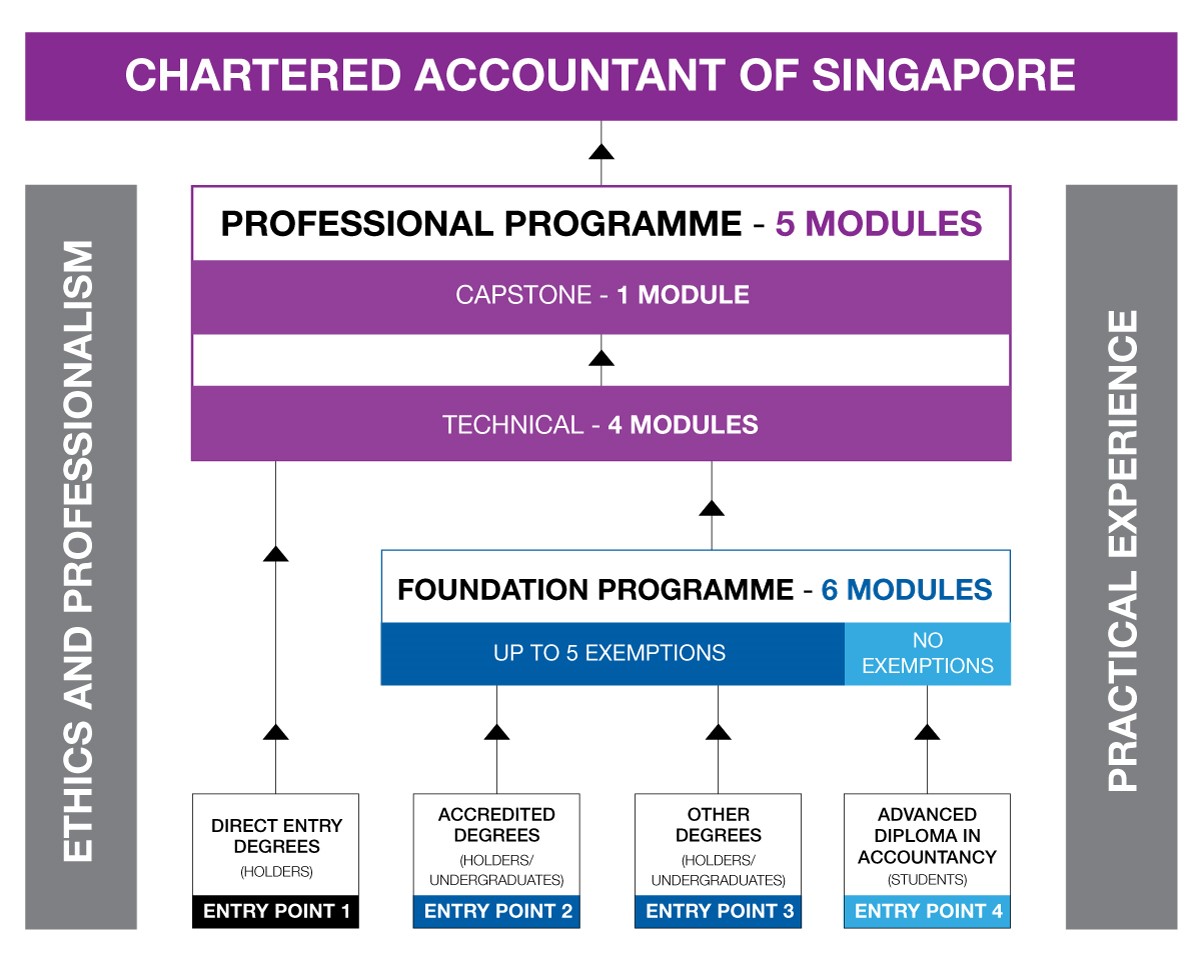

The Singapore CA Qualification is a comprehensive post-graduation accountancy programme equipping you with the necessary skills and knowledge needed to be a Chartered Accountant of Singapore (CA (Singapore). Upon completion of the Singapore CA Qualification, candidates will be conferred the CA (Singapore) designation.

Registered Learning Organisation (RLO)

LSBF has achieved the Registered Learning Organisation (RLO) Status for Professional Programme for Singapore CA Qualification.

London School of Business and Finance is authorised to conduct tuition classes for candidates of the Singapore CA Qualification Programme in the following modules:

Professional Programme

1. Assurance

2. Business Value, Governance & Risk

3. Taxation

4. Financial Reporting

5. Integrative Business Solutions (Capstone Module)

London School of Business and Finance’s RLO status is valid up to 30 June 2025. See certificate here.

CA Professional Schedule

Request More Information

Contact a programme advisor by calling

+65 6580 7700