CATEGORIES

Navigate Our Blog Library

LSBF SINGAPORE Campus EXPERIENCE

A Tapestry of Learning and Growth

Welcome to LSBF Singapore Campus’s blog, where we delve into diverse facets of education, innovation, and student life.

Explore insightful articles on accountancy, management, technology, sustainability, and more, offering a comprehensive view of our dynamic educational community.

Latest News

Press Releases

Press Releases

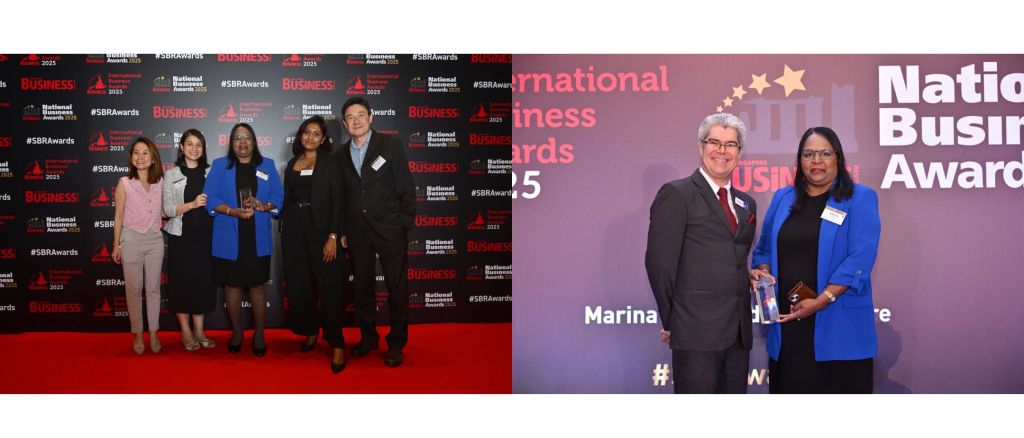

LSBF Singapore Clinches Double Victory at the Employee Experience Awards 2025

The London School of Business and Finance (LSBF) Singapore Campus has emerged as a double winner at the highly acclaimed Employee Experience Awards 2025 held in Singapore. LSBF Singapore was honoured in two key categories: Best Organisational Change Leadership and Best Remote Work Strategy, a testament in fostering a supportive, adaptable, and high-performing work environment. […]

`

`